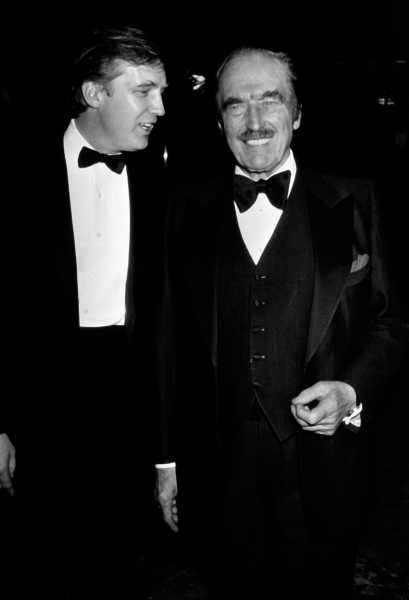

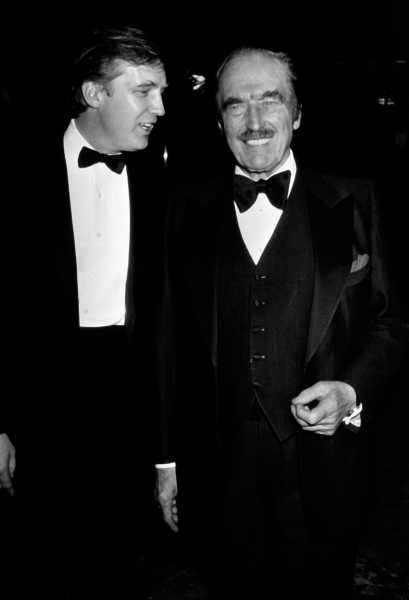

On Tuesday, the New York Times published a bombshell investigation that claims President Donald Trump — who repeatedly bragged on the campaign trail about being a “self-made” billionaire — actually inherited his wealth largely through creative, and possibly illegal, accounting done alongside his father, real estate mogul Fred Trump.

Though Trump has repeatedly boasted about using his business acumen to transform a “small loan” of $1 million from his father into billions, the Times found something quite different. When the younger Trump was just a toddler, the report says, Fred Trump began giving him part-ownership of several properties. Doing so allowed the elder Trump to funnel money directly into his son’s accounts, thus letting him sidestep the 55 percent gifts and inheritance tax. Fred Trump also gave his son at least $60.7 million in loans, many of which were interest-free and not tethered to a repayment schedule.

Some key takeaways from the report:

As the Times notes in its investigation, there’s a fine line between legal tax avoidance and illegal tax evasion. Some of Fred and Donald Trump’s actions, such as the casino debacle, are clearly illegal. Other things that sound illegal — like avoiding inheritance taxes through a network of trusts — may not be. I talked to Lee-Ford Tritt, a tax law professor at the University of Florida whom the Times consulted for its report, to help me try to make sense of it all. Our conversation has been edited for length and clarity.

Gaby Del Valle

So one thing [the Trump family] did was funnel money from Fred to Donald by giving him part-ownership of buildings. And then they set up shell companies to disguise gifts as business transactions?

Lee-Ford Tritt

The shell company that they’re talking about had two major issues. One, they could inflate the cost of capital improvement on their rent-stabilized apartments. If you put in capital improvements, they could increase those rents. So [Fred Trump] faked capital improvements. Some of that would’ve cost them, say, $20,000, and he was charging, say, $60,000. And by charging himself $60,000, marking up his own boilers and things like that, he was also reducing money out of his estate and passing it on to his children, who owned this shell company.

Gaby Del Valle

So that’s why by the time that Fred Trump died, he was worth a lot less than he was just a few years before?

Lee-Ford Tritt

All estate-planning attorneys want their very wealthy clients to die bankrupt, because they don’t want any estate and gift tax.

Gaby Del Valle

And how much of this is illegal? How do you determine what here is illegal and what isn’t?

Lee-Ford Tritt

It depends on what conclusions you take from the documents they were looking at.

A lot of this, a lot of the wealthy clients do. I think Americans don’t know what they do, and they’re shocked. I think the New York Times reporters were shocked by some of this, and I was like, “No, that’s not illegal.” Probably all uber-rich Americans do this. It’s in the statutes, the courts have approved it, they just do it.

Pushing it to an extreme, you can get into some trouble. So, for instance, when [the Trumps] were valuing their properties, there was this one property they wanted to get a charitable deduction for, and [the appraiser] valued it amazingly high, and that was good for them because they were going to give it to charity and they get to write off charitable deductions from the income tax. Then a very similar property, they transferred it [from parent to child] and they valued it very low to get out of the estate and gift tax. That would be illegal if they knowingly submitted false valuation reports to the IRS.

I think the president’s lawyer would say, “Experts handled all of this.” Well, one, that’s never an excuse for breaking the law. And two, the Trumps, this is their business. They’re not one-time players; they’re constantly involved in the valuation and understanding of the real estate market. They would understand if these were real values or not, and that would be illegal.

Gaby Del Valle

Could they say that valuation is subjective and that’s why there could be a big difference between what one appraiser says versus another?

Lee-Ford Tritt

No two properties are exactly alike, so even though the New York Times was [comparing Trump properties to similar ones in order to determine their value], there would be differences in the properties that would have the valuations. But to have that extreme of fluctuation in valuations, especially with such a short period of time with very similar properties, is rare.

Two, [the appraisal] has to be a good-faith base, and so that’s the difference. Were these [appraisals] presented [fraudulently]? Do they have the objective, the mens rea to submit false reports, or do they actually truly believe it? Would it pass the laugh test? So they might say, “No, no, no, we truly believe this.”

It’s just the circumstantial evidence that makes it suspect. Yeah, they could always have a response, but if they were submitted falsely, that’s illegal. When the New York Times talks about the grantor-retained annuity trust, I think every estate planner will tell you all wealthy planners use GRATs. And I would say yes, they do that, and they reduce [clients’] taxes, but falsifying the valuation of the property that you’re putting into that trust, that’s illegal. That’s where they pushed it too far. They supercharged it.

Gaby Del Valle

Could you briefly talk about the different legal mechanisms for tax avoidance that the uber-wealthy use?

Lee-Ford Tritt

Giving away property for charitable donations reduces your income tax liability. For estate and gift [taxes], you could do it as well.

This would take a long time to explain, all the products that estate planners use to reduce taxes. So few people are subjected to the estate tax, and then we give those people legally a lot of loopholes. We allow people to devalue their property. So, for instance, if I owned a piece of property worth $1 million, and I gave you a 40 percent interest in it, [that stake] wouldn’t be worth $400,000. I wouldn’t be taxed for a $400,000 gift, because I’m the controlling interest of the property and you weren’t there to make any decisions on it.

We would devalue that. We would say, “That $400,000 gift is worth only $200,000.” And then I could give you another $400,000, [devalue that money], and that would still be a minority interest. And eventually, I could give you everything and never pay the full price on the gift. And then GRATs are another mechanism where we play with the value of money and the interest rates. There’s lots of things that the rich will do to avoid taxes legally.

“All my friends who are estate planners are calling me up and going, ‘What’s the big deal? We do this for all our clients.’”

Gaby Del Valle

The Times piece notes that a lot of this — even if it was illegal, it’s not like it can be prosecuted now.

Lee-Ford Tritt

There’s a statute of limitations on the estate of Fred Trump, and that would have been three years. But if [Fred Trump’s children] knowingly gave false information, that could be opened. Now, if the estate doesn’t have any money — it’s been distributed — the IRS could go after the children, the beneficiaries, to get the money back.

I don’t know what the children reported on their income taxes, because I don’t know if these transfers were sales to the children or gifts. They seem to be very complicated. So the children might be liable for what they reported on their own income taxes, and that could still be opened up, although there are statutes of limitations on some of them — if they were done with fraud, [the IRS] could open it up.

Gaby Del Valle

The Trump administration is basically saying there’s nothing here. Is there any veracity to that?

Lee-Ford Tritt

I would say 80 percent of this, 85 percent of this, would be a yawn for the uber-wealthy estate planners. Like, all my friends who are estate planners are calling me up and going, “What’s the big deal? We do this for all our clients.” And once again, that’s a different story — that’s, “Should we allow this or not? Look at what the uber-wealthy are doing.”

But if [the Trumps] falsified valuations or played really aggressively with them, that’s different. If they used these shell corporations to rig the rate increases in the rent-stabilized apartments, that’s something different. There’s smoke there — there could be serious issues there. Now, the president might say, “This is my father. If there was fraud, this was him, not me.” Except the Times has done a good job of showing that he was integrally involved in all of this.

Gaby Del Valle

Are these loopholes in the tax code, or is it just the way things are? And can the government do anything about it?

Lee-Ford Tritt

It’s funny because people talk about them being loopholes, but they’re technically not. These are literally the statutes and what the courts have said are fine. GRATS are so commonly used by the uber-wealthy, and they’re so effective. They can wipe out gifts and estate taxes, hundreds of millions of dollars.

The Obama administration tried to shut them down, but it wasn’t passed by Congress. These devaluation issues I was trying to describe to you, the Obama administration tried to shut them down, saying you can only do them for legitimate business purposes, you can’t do them to avoid estate and gift taxes. Congress didn’t pass that law either.

Gaby Del Valle

One thing that I’m pretty confused about is, at least in terms of the rent-stabilized apartments, [the Trumps] boosted the value of the apartments with inflated costs [through a shell company], but then when these buildings were appraised, they were shown as being really low in value. This just doesn’t make sense.

Lee-Ford Tritt

These are all just strange valuation issues. This is the story I got from the New York Times, when I looked at it and they said, “What was your big takeaway?” I was like, “Wow, they were the masters of valuation manipulation.”

Every one of these things — every issue that the New York Times brings up, the GRATs, these rent-stabilized apartments, every property, everything, there’s a valuation issue involved in there. They’re so blatant and brazen about it. They’re using one valuation for one purpose and they’re changing it for another purpose. And so, you know, what’s so interesting is some of the [formerly rent-stabilized] apartments, they turned into condos, and then they reappraised them for a totally different value. I understand why you don’t understand it; it’s very strange.

One of those apartments, it was in the red — it was worth negative money [on paper]. They were making hundreds of thousands of dollars a month off it.

Gaby Del Valle

So it’s designed to be convoluted?

Lee-Ford Tritt

I think so. And the IRS is so strapped for time, it’s strapped for money and employees in the estate and gift tax divisions, they just can’t catch all of this stuff. And when they do, [the property owners] usually compromise and say, “Okay, I’ll pay 10 percent more,” and the IRS is happy. But really, you were scared about paying 60 percent more, so you just won.

Gaby Del Valle

Is the IRS in a better or worse position to go after this kind of thing than they were 20 years ago?

Lee-Ford Tritt

They’re in a worse position. So few people pay estate and gift taxes. A husband and wife have to have over $20 million to be subjected to the estate and gift tax.

It doesn’t bring in a lot of revenue, plus so few people do it, and there are so many ways to get around them and reduce your estate tax burden that they just don’t have the manpower. Something really has to catch [the IRS’s] attention for them to go off of something like that.

These GRATs that they were talking about, what Fred and his wife did, those GRATs are designed to create zero gift and estate taxes. They [the IRS’s estate and gift tax division] don’t really even have an incentive [to investigate], because they’re not thinking about how the valuation was rigged.

Gaby Del Valle

Bloomberg reported that New York City Mayor Bill de Blasio is going to try to go after the unpaid taxes. Can he do that?

Lee-Ford Tritt

Yes, and so could the IRS. Even though the statute of limitations has run out and [Fred Trump’s] estate is closed, if things were done fraudulently, if they purposely misled, [the IRS] could reopen [investigations] or go after the money. The problem is the estate is closed and the money has been distributed, but there are rules within the IRS that say they can go after the recipients of the money.

This isn’t a criminal action; this is just, you know, trying to get restitution.

Sourse: breakingnews.ie

0.00 (0%) 0 votes